Update [Tue 25th Jan, 2022 14:15 GMT]: Bloomberg is reporting that Nvidia is about to abandon its proposed $40 billion purchase of British chip designer Arm from SoftBank. The move was revealed in September of 2020.

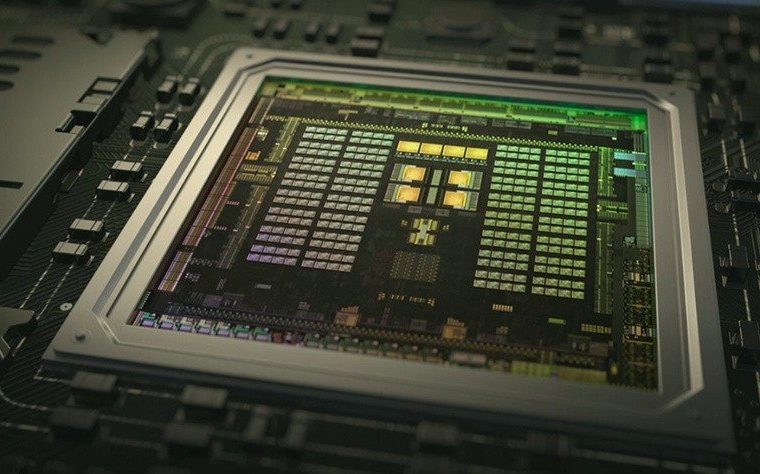

Nvidia – which makes the chips which power the Switch, Switch Lite and Switch OLED – has apparently told partners that it does not expect the deal to reach its conclusion. Meanwhile, SoftBank is preparing for an initial public offering (IPO) of Arm.

Speaking to Bloomberg, an Nvidia spokesperson said that the firm still thinks the acquisition “provides an opportunity to accelerate Arm and boost competition and innovation.”

Arm and SoftBank are yet to comment on the report, but there were doubts at the time the deal was announced that it would get past North American, British and EU regulatory bodies, with concerns being raised that such a merger would be bad for competition.

Original Story [Mon 14th Sep, 2020 09:30 BST]: Arm – the British semiconductor design firm behind the mobile tech found in millions of devices worldwide via companies such as Apple, Microsoft and Qualcomm – is being acquired by Nvidia from Japanese company SoftBank for a whopping $40 billion.

Initially, at least, it seems that Nvidia is keen to keep things as they are, and Arm will continue to be based in the UK – Nvidia has even pledged funds to create an AI research centre at Arm’s HQ, which hints that the deal is more about the future of AI than it is leveraging Arm’s network of technology. Nvidia has also stated that it intends to create massive Arm-based data centres for cloud computing and other uses.

However, in the long term, it’s not unreasonable to see the acquisition as Nvidia’s way of forcing its way into the CPU sector, an area in which it has traditionally struggled. The company’s primary area is creating GPUs, and outside of its Tegra “system on a chip” line – which is used in the Nintendo Switch – it is more concerned with AI and in-car tech.

Early Tegra chips were intended for smartphones and MP3 players like the ill-fated Microsoft Zune, but Nvidia found it difficult to make headway in a smartphone sector dominated by Qualcomm’s Arm-based Snapdragon chipsets, and instead focused on putting its silicon into tablets and self-made devices, like the Nvidia Shield line – the creation of which arguably helped catch Nintendo’s eye when it came to the tech it wished to use inside the Switch.

Arm’s business model is based around licencing its IP to other companies for manufacture, rather than producing the chips itself. That means once the deal goes through, Nvidia (via Arm) will receive a royalty on every Arm chipset manufactured in the world.

For Arm, it’s yet another indication of how successful the business – which was founded back in 1990 off the back of Acorn Computers’ Archimedes home computer – has become in recent years. Arm chips are used in almost all smartphones these days, and have previously been found in the Game Boy Advance, Nintendo DS, 3DS and Switch (Nvidia’s Tegra “System on a chip” uses Arm silicon as its CPU). Apple has recently decided to use Arm chips in its future MacBooks, and Microsoft is also creating a version of Windows and Surface OS which will run on Arm. That goes some way to explaining why Nvidia has had to pay $10 billion more than the $30 billion SoftBank purchased the firm for in 2016 – at a time when Nvidia was worth roughly the same. Today, Nvidia is worth $300 billion.

So, how does this benefit Nintendo? Nvidia and Arm now being under the same roof (so to speak) is only going to make the former’s position in the market more secure; it will now have a major degree of influence over the world’s most popular mobile CPU technology (although it has been stated that Nvidia intends to keep Arm “neutral”, so it won’t gain any unique advantage, at least to begin with) and that could bode well when it comes to Nintendo’s position in the games hardware market over the next decade – assuming it decides to stick with Nvidia’s Tegra chips, of course.

The success of Arm will now directly benefit Nvidia, which will only strengthen the company’s position in the mobile chipset market. Nvidia is already a world-leader when it comes to GPU technology (an area in which Arm is also involved, via its Mali chipsets), so having closer involvement with Arm’s world-beating mobile CPU products could lead to some particularly exciting developments in the realm of portable computing – developments which could potentially shape the future of the Switch brand.